What Is Trade Credit Insurance Fundamentals Explained

Wiki Article

The 9-Second Trick For What Is Trade Credit Insurance

Table of ContentsOur What Is Trade Credit Insurance IdeasEverything about What Is Trade Credit Insurance9 Easy Facts About What Is Trade Credit Insurance ShownThings about What Is Trade Credit InsuranceIndicators on What Is Trade Credit Insurance You Should Know

ECI, the expense of which is commonly integrated into the asking price by exporters, must be a positive purchase, because exporters ought to acquire coverage prior to a client becomes a trouble. ECI plans are used by numerous private industrial risk insurance provider as well as the Export-Import Bank of the USA (EXIM), the government company that helps in funding the export of U.S.

For more on debt insurance policy, visit the EXIM internet site.

What Is Trade Credit Insurance Fundamentals Explained

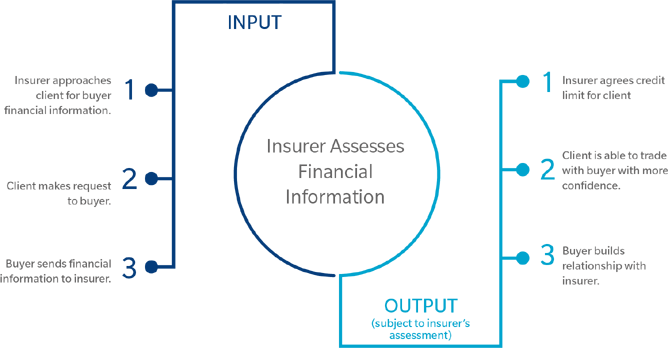

Trade Credit score Insurance coverage provides access to information held by insurers regarding the financial health and wellness of companies you are preparing to do service with. Insurance providers can share this details with their insurance policy holders. Your consumers have a vested rate of interest in ensuring their suppliers can acquire profession credit report insurance as well as supply details of their as much as day trading task to the insurance providers.

If you are taking into consideration making use of invoice finance, profession credit rating insurance coverage can provide your financing firm with the safety they require to provide additional financing. Using Trade Credit score Insurance to provide clients and also prospects much more beneficial debt payment terms and also restrictions. This can have a substantial impact on your sales performance.

While we have no known connection to Julie Andrews, right here at The Network Collaboration our company believe in learning more about our client. Most of all, please do not think we merely 'supply' profession credit scores insurance coverage. Our solution exceeds that also if you select not to deal with us at the end of the day.

Some Known Questions About What Is Trade Credit Insurance.

Or, if we believe that credit insurance isn't ideal for your service, then we'll be honest and put in the time to describe why we think this is and also detail alternate options we think it's the ideal thing to do. We value our individuals who are the backbone to what we do, as well as this is reflected in the solution that we offer to our customers.For a lot of companies, the worth of the debtor's journal, the money you are owed, is just one of the biggest possessions and also yet it is commonly not insured. A lot of companies ensure various other essential properties readily, yet the threat to a service of customer bankruptcy can be one of the most uncertain exposures.

Unless you require payment ahead of time or are covered by debt insurance coverage, this makes you at risk to uncollectable bill (What is trade credit insurance). Ask yourself, what would be the influence of among your largest clients falling short to pay you? Any kind of business marketing items and services on credit history terms with exposures to uncollectable bills need to highly consider trade credit sites rating insurance coverage as part of their service threat approach.

Trade Credit score Insurance policy is greatly used in the Building and Building and construction field as well as made use click this link of by organizations of all dimensions with minimum yearly turn over normally beginning around $750,000 upwards. There is no 'one dimension fits all' technique when it involves Profession Credit score Insurance policy and also the degree as well as cost of your policy will be dictated by your demands.

The Single Strategy To Use For What Is Trade Credit Insurance

For 2 years organization has actually been battered. We have a wide option of items ensured to insure your service against the unanticipated; discover out which one works for you.Our major focus is to be the leading Profession Debt, Insurance coverage along with Surety & Bonds solutions provider, by supporting our customers' expanding need throughout, Africa. Get an insightful, inside search profession credit history insurance policy with our newest news and also updates.

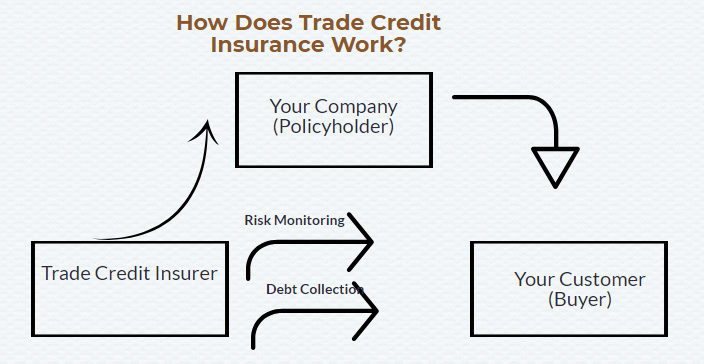

Trade credit score insurance is a method of securing your receivables (billings) from non payment. It is an increasingly popular form of security versus clients which either decline to, or can not, pay their financial obligations. What is trade credit insurance. Allow's discover how it functions Material Profession debt insurance, sometimes called 'negative debt protection', is an insurance cover for companies against consumers that do not pay their debts.

It can be made use of as a standalone item covering the whole company accounts receivable; as a bolt on for invoice finance; or to cover a certain part of a business's invoices, for instance those from exports only. Profession debt insurance policy is now a popular area with different solutions tailored to various sections of the market.

The 15-Second Trick For What Is Trade Credit Insurance

Experts use what are called actuarial strategies (statistical analysis of risk find here in insurance policy) to check out the sector of profession, the credit report of the business entailed, previous poor debt experience as well as a variety of other elements. Based upon this evaluation, the expert will establish a credit limit for every firm to which the credit score insurance coverage will use.In some circumstances this might not cover the total amount of the trade but a percent just. Along with its fundamental security, debt insurance coverage has actually the included worth of offering insight into the credit-worthiness of your consumers (What is trade credit insurance). This might allow you to make smarter strategic decisions as you grow business.

Report this wiki page